Florida remains one of the most sought-after real estate markets for families, investors, and international buyers. With its strong economy, sunny weather, and tax-friendly environment, the Sunshine State continues to attract those seeking both lifestyle and financial opportunity. Among its many real estate options, pre-construction homes stand out for their potential appreciation, modern design, and flexible payment structures.

Why Invest in Pre-Construction Homes in Florida

The growing population, booming tourism, and steady job creation across cities like Orlando, Miami, and Tampa have fueled demand for new housing. Developers are responding with innovative communities featuring smart designs, energy-efficient technologies, and resort-style amenities.

Buying pre-construction allows investors to lock in today’s prices before values rise as construction progresses. For families, it’s a chance to personalize their future home from the ground up, choosing finishes, layouts, and upgrades that fit their lifestyle.

How Pre-Construction Sales Work

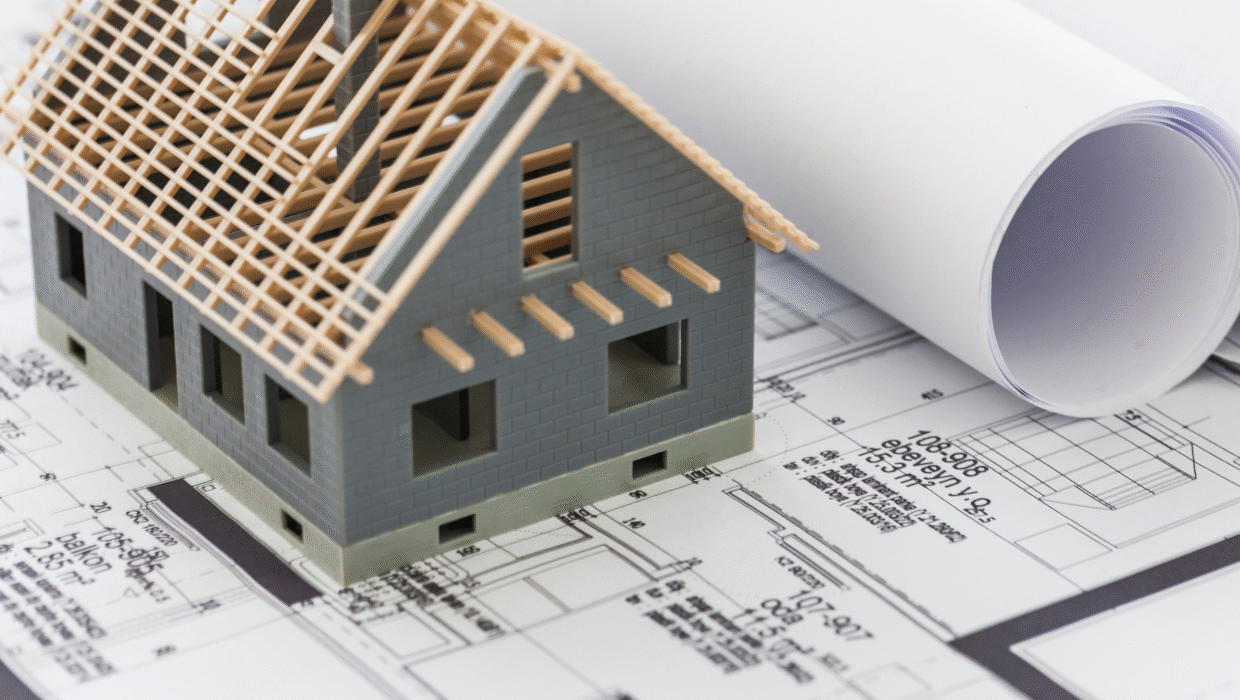

When purchasing a pre-construction property, you’re buying before the home is built. Developers release floor plans, renderings, and pricing in phases. Early buyers typically enjoy the lowest entry prices and incentives such as closing cost credits or design upgrades.

As the project sells and construction advances, prices often increase. This phased model means early investors can benefit from property appreciation even before the home is completed.

Contracts in Florida are legally binding and outline the deposit schedule, expected completion date, and terms for delays or cancellations. Working with a licensed Florida real estate agent is crucial to ensure your rights are protected.

Step 1: Reserve Your Unit

Most developers start with a reservation phase, where buyers can secure a specific lot or unit with a small refundable deposit. This step gives you time to evaluate the floor plan, location, and financing before signing the official contract.

Premium lots—like corner units or lakefront views—often carry higher costs but also deliver stronger resale value.

Step 2: Sign the Pre-Construction Contract

Once you’re ready to move forward, you’ll sign a purchase agreement with the developer. This document sets out the total price, deposit structure, and timeline.

Deposits are usually paid in stages—such as 10% at contract signing and additional amounts during construction. These funds are often held in escrow for added protection.

At this point, having both a real estate attorney and experienced agent review your contract is essential to safeguard your interests.

Step 3: Secure Financing

Financing for pre-construction properties differs from traditional home loans. Most mortgages can’t be finalized until construction is complete.

Many U.S. buyers use construction-to-permanent loans, while international investors often purchase in cash to avoid exchange rate issues or lender delays. Developers may also partner with preferred lenders to simplify pre-approvals and streamline the process.

Step 4: Monitor Construction Progress

Building timelines can range from one to three years, depending on the size of the project. Throughout this period, developers typically share progress updates, photos, and milestones.

Stay engaged—ask for site visits and ensure the finishes, design, and materials align with what’s been promised. This proactive approach helps you catch issues early.

Step 5: Closing the Deal

When construction is complete and the certificate of occupancy is issued, it’s time to close. You’ll pay the final balance, complete your mortgage process, and receive the title.

Before signing, conduct a final walk-through or inspection to confirm that everything meets the agreed specifications. Expect closing costs such as title insurance, recording fees, and escrow charges.

Opportunities and Risks

Advantages:

- Lower initial prices and high appreciation potential

- Customizable design and modern amenities

- Strong rental demand for new builds

Risks:

- Possible construction delays

- Market shifts during the building period

- Long waiting time before occupancy or income

By partnering with an experienced agent and a reputable developer, you can reduce these risks and make a sound long-term investment.

Partnering with Experts: Seven Realty

Navigating Florida’s pre-construction market requires experience and insight. Seven Realty specializes in connecting buyers—both local and international—with top developments across Orlando, Tampa, Miami, and beyond.

From evaluating projects to reviewing contracts and coordinating financing, Seven Realty offers end-to-end support, ensuring your investment is safe, strategic, and profitable.

Conclusion

Buying a pre-construction home in Florida is more than a transaction—it’s an opportunity to build equity, design your dream home, and secure a foothold in one of the most dynamic real estate markets in the world.

Whether you’re seeking a new residence or a strategic investment, understanding each step—from reservation to closing—empowers you to make confident, informed decisions.

Ready to explore pre-construction opportunities in Florida? Contact Seven Realty today and gain early access to the most promising developments before they hit the market.

FAQ

What are the main benefits of buying pre-construction in Florida?

You can lock in lower prices, customize your property, and benefit from appreciation before the home is completed.

How much deposit is typically required?

Most developers require around 10–20% of the purchase price, paid in stages as construction progresses.

Can international buyers purchase pre-construction homes in Florida?

Yes! Florida welcomes international investors. Many developers and lenders offer tailored solutions for non-resident buyers.